Set clear expectations with clients and organize your plans for each projectĬlient management made easy, with client info all in one placeįreshBooks integrates with over 100 partners to help you simplify your workflows Organized and professional, helping you stand out and win new clients Track project status and collaborate with clients and team members Tax time and business health reports keep you informed and tax-time ready Reports and tools to track money in and out, so you know where you standĮasily log expenses and receipts to ensure your books are always tax-time ready Quick and easy online, recurring, and invoice-free payment optionsĪutomated, to accurately track time and easily log billable hours

BOOKKEEPING SOFTWARE AUSTRALIA PROFESSIONAL

You can also use our example chart of accounts as a reference.Wow clients with professional invoices that take seconds to create Determine if each sub-account needs further sub-accounts – this will depend on the level of information you need.Īccounting packages have predefined chart of accounts that you can allocate to your own financial transactions.Allocate various sub-accounts under these main accounts.For example, all asset accounts will be classified under the 1000 number, and all liability accounts will be classified under the 2000 number. Allocate a numbering system for each account within the chart of accounts.

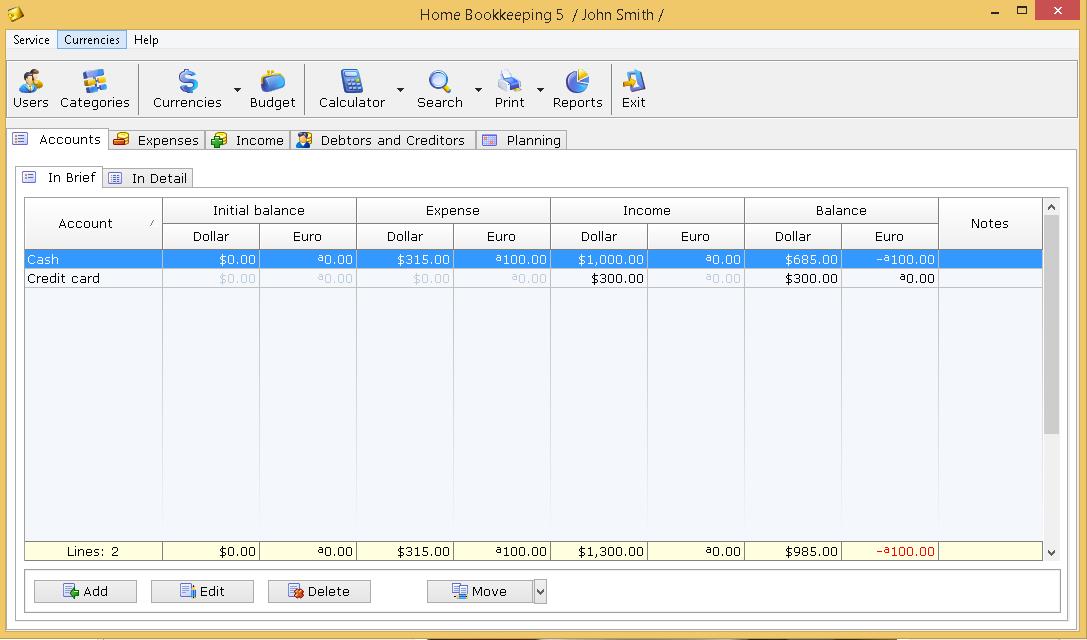

Make a list of these accounts under the financial classifications as noted above – each different type of account for assets, liabilities, sales revenue and expenses.Define the accounts to be used in the business, such as different classes of assets, liabilities, expenses and sales revenue.When setting up a chart of accounts, you'll need to: The chart of accounts is important to show how effective and accurate your bookkeeping is. It's also used to determine the overall financial position of a business in a balance sheet. Classifications separate profit and loss calculations to show where a business is making or losing money. A chart of accounts is a listing of all the accounts needed to cover the financial transactions of the business. This is done through setting up classifications, also known as a chart of accounts. When you set up your financial records, you need to make sure they comply with GST and other tax obligations. The ATO's software solutions page can help you find software products that allow STP reporting, including low-cost options for micro employers. If you are already using accounting software, STP reporting should be built in. This is known as Single Touch Payroll (STP). Some commonly used accounting systems used by small businesses are:įrom 1 July 2019, businesses with fewer than 19 employees are required to report tax and superannuation information directly to the ATO (larger employers with 20 or more employees began reporting requirements earlier).

BOOKKEEPING SOFTWARE AUSTRALIA FREE

Some of them are free, such as Free Accounting Software. There are many software packages on the market that allow business managers to successfully control records without an accounting degree.

0 kommentar(er)

0 kommentar(er)